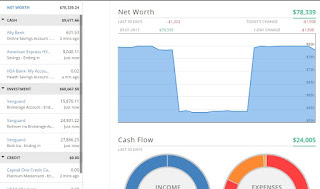

$78,339

My last reported net worth was $79,542, so the difference is $1,203. Not too bad since I have no money coming in. As a matter of fact, that's probably one of the lowest expense months I've had in a long while.

Some of the things that I think help contribute to such low expenses are: not driving anywhere near as much as I did when I had to commute to a job; buying only necessities when buying groceries and buying items I could cook myself and then stretch into leftovers; eating at home vs eating out (although this is something I almost always try to do). However, I think the biggest factor in this difference is that we've had a pretty good market so far. Capital gains really offsets the decrease in capital I've taken out to pay some bills.

I completed the rollover process to get my 401k into a tIRA (that's the gap you'll see in the screenshot below). Something that isn't reflected (because it hasn't happened yet) is a $3,000+ bump in the rollover IRA. After I completed the rollover process, I noticed there was still a balance showing in my old 401k account. It turns out I received a profit sharing contribution from my former employer after the fact. I've initiated a rollover to that, too, but it's in progress. That means my actual net worth is about $3,200 to $3,400 more than reported here, but I always report what I currently have. Who knows? Some thief could hijack that check before it reaches me.

I had two job interviews this week that both went really well. Hopefully, one of them will pan out and I can continue to put money away instead of watching it slowly trickle out. So far, that's the most difficult thing I've endured: watching the money I've aggressively saved slowly dwindle. Now I know how difficult it is to overcome the need to worry about saving vs spending when one is not in the accumulation phase, although I'm not exactly out of the accumulation phase nor anywhere near financially independent. It is a huge relief to not have to worry about paying bills though. Being unemployed is already stressful enough.

During my down-time, I've enjoyed learning some new technologies and have taken a weekend vacation with my wife recently. We've got a European trip booked for May, too, and I'm planning another weekend trip with my brothers. So, lots of fun and exciting travel in my immediate future.

I applied for a new credit card and got approved, so that will increase my credit limit, which will eventually raise my credit score some more. Last I checked, I was 743 at one agency and 744 and another, so I'm almost in the excellent credit range. A little over a year ago, I was in the mid-500s.

That's about it for this update, I think. Despite being unemployed for a month and a half, things really aren't so bad and they look to be getting better. Check back in next month for my next report. I hope to have even better things to say.

|

| Obligatory screenshot for Feb 2017 |

EDIT: I was reviewing my screenshot and noticed my HSA account was showing 2 cents. There wasn't much in it. Something like $436 since I only contributed in January. I initiated a transfer of that money so I could invest it, but had since forgotten about it. Guess I need to go take care of that now. Just wanted to clarify why that account is showing the amount listed.

No comments:

Post a Comment